Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

TurboTax is the biggest and most popular tax preparation software for Professionals in the United States, handling a staggering 30 million tax returns each year. And there’s a good reason for that – TurboTax is incredibly easy to use and can help you get your taxes done in a fraction of the time it would take to do them yourself.

But even if you’re not dreading tax season, it’s still important to be prepared. In this blog post, we’ll give you a brief introduction to TurboTax online software, and show you how to use it to get your taxes done quickly and easily.

TurboTax is the best tax software for professionals for several reasons.

1. it’s the most popular tax software on the market, so you can be sure that there’s a lot of support for it.

2. it’s very user-friendly, so even if you’re not a tax expert, you can still use it without any problems.

3. it’s very affordable, so you won’t have to spend a lot of money to get your taxes done.

4. it’s very accurate, so you can be sure that your taxes will be done correctly.

5. it’s very easy to use, so you won’t have to waste a lot of time trying to figure it out.

6. it’s available in both English and Spanish, so you can choose the language that you’re most comfortable with.

7. it has a lot of features, so you can be sure that you’ll find all the tools you need to get your taxes done.

8. it’s constantly being updated, so you can be sure that you’re using the most current version.

9. it’s backed by a 60-day money-back guarantee, so you can be sure that you’re satisfied with it.

10. it’s the only tax software that you need, so you can be sure that you’re getting the best value for your money.

If you’re like most people, the mere thought of doing your taxes fills you with dread. However, the process doesn’t have to be so painful. Filing your taxes online can be quite simple and convenient.

Here are just a few of the benefits of e-filing your taxes:

1. You can do it from the comfort of your own home.

2. You don’t have to go to the post office or stand in line at the tax office.

3. You can e-file your taxes for free. That’s right, many websites offer free e-filing for federal and state taxes.

4. E-filing is fast and easy. Once you’ve gathered all of your documents, you can usually complete your tax return in just a few minutes.

5. You’ll get your refund faster. If you e-file and choose direct deposit, you could get your refund in as little as two weeks.

So why not give e-filing a try? It just might make doing your taxes a whole lot easier.

TurboTax Online is one of the most popular online tax preparation and filing services available. Here are some of the key features that make it a great choice for taxpayers:

1. Ease of Use: TurboTax Online is designed to be extremely user-friendly, even for those who have never filed taxes online before. The interface is straightforward and the process is broken down into simple steps.

2. Accuracy: TurboTax is known for being accurate, which is important when it comes to filing taxes. This means that users can feel confident that they are getting the maximum refund or owe the minimum amount of taxes.

3. Security: TurboTax takes security seriously, with encryption and multi-factor authentication to protect users’ sensitive tax information.

4. Support: TurboTax offers extensive support, both online and via phone, to help users with any questions or issues they may have.

5. Refunds: TurboTax users can get their refund deposited directly into their bank account, or receive it via check or PayPal.

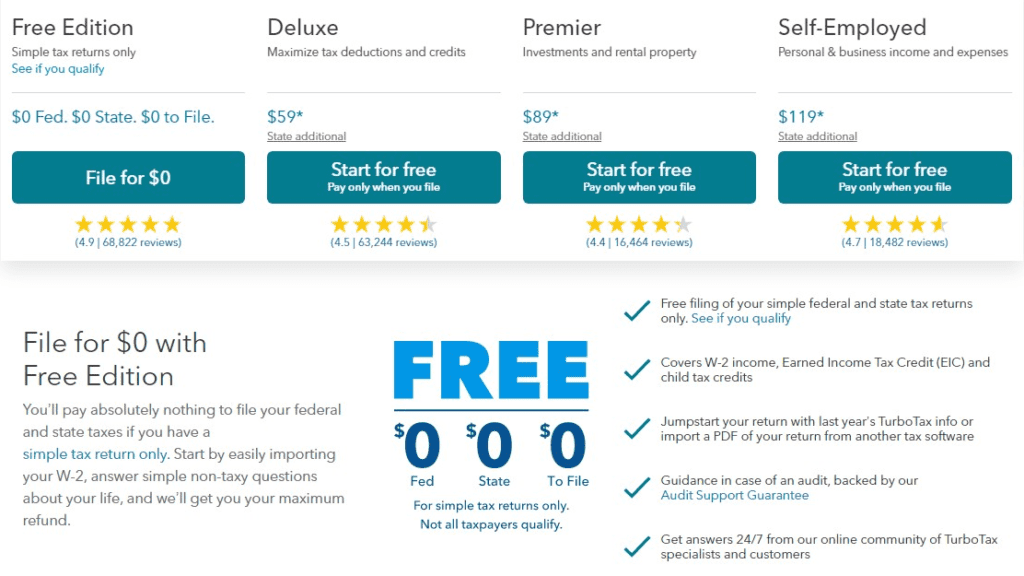

6. Pricing: TurboTax offers a variety of pricing options, depending on the complexity of the user’s tax situation. There is also a free version for those with simple taxes.

Whether you’re a first-time filer or a seasoned tax pro, TurboTax Online is a great choice for preparing and filing your taxes.

TurboTax software is designed to guide users through their tax returns step-by-step, and it makes filing taxes much easier than doing them by hand.

Here’s a step-by-step guide to using TurboTax:

1. Choose the right TurboTax version. There are four different versions of TurboTax, each designed for a different tax situation. Choose the one that best fits your needs.

2. Gather your tax documents. You’ll need things like your W-2 form from your employer, 1099 forms if you’re self-employed, and records of any deductions or credits you’re claiming.

3. Enter your personal information. TurboTax will ask you for basic information like your name, address, and Social Security number.

4. Answer questions about your income. TurboTax will ask you questions about your income, such as how much money you made last year and whether you had any deductions or credits.

5. Review your deductions and credits. TurboTax will help you find deductions and credits you’re eligible for, and you can choose which ones to claim.

6. Review your tax return. Be sure to double-check your work before you file your taxes.

7. File your taxes. Once you’re satisfied with your tax return, you can file it electronically or print it out and mail it in.

When it comes to tax season, many people dread having to file their taxes. However, with TurboTax online, you can get your taxes done quickly and easily. Best of all, TurboTax online is very affordable. Here is a look at the TurboTax online price and what you can expect when you use this service.

TurboTax online is one of the most popular ways to file your taxes. It is simple to use and very affordable. The base price for TurboTax online is Free tier to $119. However, if you need additional help, there are a variety of add-ons that you can purchase. For example, you can get help with your taxes if you are a small business owner or if you have complex taxes.

TurboTax is a great way to get your taxes done quickly and easily. The price is very reasonable, and you can get a lot of help if you need it.

No one likes tax season. It’s the time of year when we have to gather up all of our paperwork and receipts and figure out how much money we owe the government. It can be a stressful and confusing time for many people. But it doesn’t have to be. TurboTax is here to help you get your taxes done quickly, easily, and stress-free.

TurboTax is the leading tax preparation software and it can help you get your taxes done in no time. It’s easy to use and it’s accurate, so you can be sure you’re getting the most money back. And if you have any questions, TurboTax has a team of experts who are always happy to help.

So don’t let tax season get you down. TurboTax online helps you get your taxes done quickly, easily, and stress-free.

You can get a TurboTax discount code by signing up for a TurboTax account. Start your taxes now with the #1 best-selling tax software. Create an account today. Order Now!

TurboTax is a tax preparation software that allows users to file their taxes online. The software is designed to make the tax filing process as simple and easy as possible. users can file their taxes in just a few minutes, and they can do so from the comfort of their own homes.

TurboTax is the largest and most popular tax preparation software in the United States. The company has been in business for over 20 years, and they have helped millions of Americans file their taxes.

The software is very user-friendly, and it is available in both English and Spanish. TurboTax also offers a mobile app, so that users can file their taxes on the go.

The company offers a free trial so that users can try the software before they buy it. They also offer a money-back guarantee, so that users can be sure that they are satisfied with the product.

TurboTax is a great option for those who want to file their taxes online. The software is easy to use, and it is available in both English and Spanish.

There are a few different versions of TurboTax, so it can be tricky to decide which one is right for you. The good news is that you can usually get by with the basic version of TurboTax unless you have a very complicated tax situation.

If you’re a sole proprietor or have a simple tax situation, the basic TurboTax should be fine. This version can handle things like W-2s, 1099s, and simple interest and dividend income. It’s also the cheapest version of TurboTax, so it’s a good choice if you’re on a budget.

If you have a more complicated tax situation, you might need to upgrade to the Deluxe or Premier versions of TurboTax. These versions can handle things like itemized deductions, rental income, and stock sales. They also include extra features like audit protection and live chat with a tax expert.

No matter which version of TurboTax you choose, you can be sure that you’re getting the best possible tax preparation software on the market. TurboTax is the most popular tax preparation software for a reason – it’s easy to use and it gets the job done right.

TurboTax can be a great way to get your taxes done quickly and easily, but what if you need to start over? If you’ve started your taxes on TurboTax but need to start over for any reason, don’t worry – it’s easy to do.

Here’s how to start over on TurboTax:

First, sign in to your TurboTax account. If you’re not already signed in, you’ll need to enter your email address and password.

Once you’re signed in, click on the “My TurboTax” tab at the top of the page.

Under the “My TurboTax” tab, click on the “Tools” menu.

In the “Tools” menu, select the “Clear & Start Over” option.

You’ll be prompted to confirm that you want to clear your tax return and start over. Click on the “Yes, clear my return and start over” button to confirm.

That’s all there is to it! Once you’ve cleared your tax return, you can start over from scratch.

Are you looking for a place to buy TurboTax? If so, there are a few different places that you can look. Here are a few of the most popular places to buy TurboTax:

1. Amazon – Amazon is a great place to buy TurboTax. They usually have the best prices on the software and they offer free shipping.

2. Best Buy – Best Buy is another great place to buy TurboTax. They typically have good prices on the software and they offer a variety of different payment options.

3. Walmart – Walmart is a great place to buy TurboTax. They usually have the best prices on the software and they offer free shipping.

4. Target – Target is another great place to buy TurboTax. They typically have good prices on the software and they offer a variety of different payment options.

5. Office Depot – Office Depot is a great place to buy TurboTax. They usually have the best prices on the software and they offer free shipping.

In 1986, Michael A. Chipman and Thomas P. Blum founded TurboTax in San Diego, California. The company has since been acquired by Intuit, but TurboTax remains one of the most popular tax preparation software programs in the United States. According to a 2016 report by the Internal Revenue Service (IRS), TurboTax is used by more than 40 million taxpayers.

While TurboTax is a widely used and trusted software program, there are some concerns about who owns the company. In 2014, Intuit announced that it would be acquired by private equity firm Silver Lake Partners for $4 billion. This deal was met with some criticism, as it would mean that TurboTax would be owned by a private equity firm rather than a public company.

Critics of the deal noted that private equity firms often have a history of cutting costs, which could lead to reduced quality of the TurboTax product. Others raised concerns about the potential for conflicts of interest, as Silver Lake Partners also owns a stake in H&R Block, one of TurboTax’s main competitors.

Despite these concerns, the deal went through and Silver Lake Partners now owns a majority stake in TurboTax. Intuit remains a minority shareholder and still has a seat on the board of directors.

Looking forward, it will be interesting to see how TurboTax evolves under its new ownership. Will the quality of the product decline as Silver Lake Partners looks to cut costs? Or will the company continue to thrive and maintain its position as the leading tax preparation software program? Only time will tell.

TurboTax is one of the most popular tax preparation software programs available. It offers a variety of features and options to help you prepare and file your taxes. But with so many different versions of TurboTax available, it can be hard to decide which one you need.

The most important factor in choosing the right TurboTax for you is determining whether you need the deluxe, premier, or self-employed version. The deluxe version is the most basic and is best for people with simple tax situations. The premier version is ideal for people with more complex tax situations, such as those who own a home or have investment income. The self-employed version is designed specifically for people who are self-employed or have a small business.

Once you’ve determined which version of TurboTax you need, the next step is to decide whether you want to use the online or desktop version. The online version is more convenient and allows you to access your tax return from anywhere. The desktop version is best for people who want the most control over their tax return, and who are comfortable working with tax software.

No matter which TurboTax you choose, you can be confident that you’re getting the most comprehensive and easy-to-use tax preparation software available.

When you file your taxes with TurboTax, you have the option to receive your refund via direct deposit. Direct deposit is the quickest and most convenient way to receive your refund, and it’s also the most secure. So how long does TurboTax direct deposit take? The answer depends on a few factors, including when you filed your taxes and how you chose to receive your refund. If you filed your taxes early and chose direct deposit, you may receive your refund as early as eight days after the IRS accepts your return.

However, if you filed your taxes closer to the April deadline and chose direct deposit, it may take a little longer to receive your refund. Regardless of when you filed your taxes or how you chose to receive your refund, you can always check the status of your refund online. Simply log in to your TurboTax account and click on the “Refund Status” tab. From there, you’ll be able to see how your refund is being processed and when you can expect to receive it. If you have any questions about TurboTax direct deposit or your refund status, you can always contact TurboTax customer service for help.

If you e-file your federal return with TurboTax, you can get your refund in as little as eight days. If you opt to receive your refund via direct deposit, it will be deposited into your account within three to five days after the IRS processes your return. If you choose to receive a paper check, it will be mailed to you within three to four weeks. You can check the status of your refund online at the IRS website or by using TurboTax’s Refund Tracker.

TurboTax is the biggest and most popular tax preparation software in the United States, handling a solid 30% of electronic filings, and it’s available for free. That’s right – free. No catches, no gimmicks, no fine print. So why is TurboTax free?

The answer is quite simple: because TurboTax knows that the best way to get more customers is to offer a great product for free. And TurboTax is indeed a great product. It’s easy to use, it’s accurate, and it’s free.

What’s more, TurboTax is backed by Intuit, a company that’s been in the business of making financial software for over 30 years. So when you use TurboTax, you can be confident that you’re getting a product from a company that knows what it’s doing.

So there you have it. TurboTax is free because it’s a great product from a reputable company. And when you use TurboTax, you can be confident that you’re getting the best possible tax preparation experience.

As a landlord, you’re always looking for ways to improve your bottom line. And one way to do that is to find the most tax-efficient way to manage your rental property.

That’s where TurboTax comes in. TurboTax offers a variety of different products that can help you maximize your deductions and minimize your taxes.

But which TurboTax product is right for you?

If you own a single rental property, then the TurboTax Home and Business edition is likely your best bet. This edition includes everything you need to prepare your personal and business taxes, including rental property income and expenses.

If you own multiple rental properties, then you may want to consider the TurboTax Business edition. This edition is designed for small businesses, and it includes all the features you need to prepare your business taxes, including rental property income and expenses.

No matter which TurboTax product you choose, you can be sure that you’re getting the most comprehensive and accurate tax preparation available. So why not give TurboTax a try this tax season? You may be surprised at how much you can save.

With the recent craze surrounding cryptocurrency, it’s no surprise that people are wondering which TurboTax version is best for handling their digital assets. While the answer may not be as simple as “TurboTax Premier,” there are a few things to consider when it comes to your taxes and cryptocurrency.

If you’re like most people, you probably have a few questions about how cryptocurrency is taxed. For example, do you have to pay taxes on capital gains from selling digital currency? And what about if you use cryptocurrency to pay for goods or services?

The good news is that the IRS has issued guidance on how to report cryptocurrency on your taxes. However, because the guidance is still relatively new, it’s important to consult with a tax professional to make sure you’re doing everything correctly.

In general, you’ll need to report any gains or losses from selling cryptocurrency on your taxes. This includes gains from selling digital currency for cash, as well as from exchanging one type of cryptocurrency for another. If you use cryptocurrency to pay for goods or services, you’ll also need to report the transaction.

Cryptocurrency is taxed as a capital asset, which means you’ll pay capital gains taxes on any profits you earn from selling it. The tax rate you’ll pay depends on how long you hold the digital currency before selling it. For example, short-term capital gains are taxed at your regular income tax rate, while long-term capital gains are taxed at a lower rate.

If you’re not sure which TurboTax version is right for you, it’s a good idea to speak with a tax professional. They can help you determine which forms you need to file and how to report your cryptocurrency transactions.

TurboTax is one of the most popular online tax preparation and filing services. They offer a free online version for simple tax returns, and their paid versions start at $29.99 for federal taxes. State taxes are an additional $39.99. They also offer a deluxe version for $49.99 that includes additional features such as live chat with a tax expert and audit support.

TurboTax files are usually stored in the My Documents folder. However, if you have selected a different location for your files, they may be stored there. To check the location of your files, open the TurboTax program and go to File > Open. In the Open dialogue box, look in the Folder list for the location of your files.

If you’re like most people, you probably have a 401(k) from your employer and a few stocks that you’ve purchased on your own. When it comes time to do your taxes, you may be wondering which TurboTax product is best for you.

The answer depends on a few factors. If you have a simple tax return with just a few stocks, the Deluxe version of TurboTax will likely be all you need. However, if you have a more complex return with multiple stocks and other investments, you may need to upgrade to the Premier or Self-Employed versions.

In general, the more complex your tax return is, the more expensive the TurboTax product will be. However, all of the products offer a free trial so you can try them before you buy.

If you’re not sure which product is right for you, the best thing to do is start with the free trial of the Deluxe version and upgrade if you need to. That way, you’ll only pay for the features you need.

TurboTax is one of the most popular tax preparation software programs available. And for good reason – it’s one of the easiest ways to file your taxes. But did you know that you can file your TurboTax for free?

Yes, there is a way to file your TurboTax for free. All you need to do is go to the TurboTax website and sign up for their free trial. With the free trial, you can file your federal and state taxes for free.

The best part about the free trial is that you don’t have to enter any credit card information. So, if you decide that you don’t want to continue using TurboTax after the free trial, you won’t be charged anything.

To sign up for the free trial, simply go to the TurboTax website and click on the “Free Trial” button. Once you’ve completed the sign-up process, you’ll be able to access the TurboTax software and begin filing your taxes.

Keep in mind that the free trial is only available for a limited time. So, if you want to file your taxes for free, you’ll need to do it before the free

TurboTax is one of the most popular online tax preparation services. If you have a simple tax return, you can use the free version of TurboTax. For more complex returns, there are paid versions. You can use TurboTax online, or you can download the software to your computer.

To use TurboTax online filing software, create an account and then enter your personal information, such as your name, address, and Social Security number. Then, answer questions about your income and deductions. TurboTax will fill in your tax forms and calculate your tax refund (or tax bill).

You can e-file your tax return with TurboTax online. E-filing is the fastest way to get your refund, and it’s free if you use TurboTax. You can also choose to receive your refund by check or direct deposit.

If you have questions about using TurboTax online, there is a help centre where you can search for answers or contact customer support.

TurboTax is one of the most popular tax preparation software programs in the United States. There are several different versions of TurboTax, each designed for different types of taxpayers. The most basic version, TurboTax Free, is designed for taxpayers who have simple tax returns. TurboTax Deluxe is designed for taxpayers who have more complex tax returns, and TurboTax Premier is designed for taxpayers who have investment income or rental property income. TurboTax also offers a version for self-employed taxpayers and a version for taxpayers who are claiming the Earned Income Tax Credit.

TurboTax is one of the most popular online tax preparation services, but some users are concerned about the safety of using the service. Here’s a look at how safe TurboTax is and how you can protect your personal information when using the service.

TurboTax is a secure website, and all of your personal information is encrypted when you use the service. However, it’s important to remember that no website is 100% secure, and there are always risks when sharing personal information online.

To help protect your information, TurboTax online offers a few different security features. First, you can create a unique login ID and password for your account. You can also enable two-factor authentication, which requires you to enter a code from your phone or another device in addition to your password when logging in.

In addition to these security features, TurboTax also recommends taking some steps to protect your computer and your personal information when using the service. For example, they recommend using a secure, private Wi-Fi connection when accessing TurboTax online. You should also make sure your computer has up-to-date security software and that you always log out of your TurboTax account when you’re finished using it.

By taking some simple precautions, you can help ensure that your personal information is safe when using TurboTax online.

TurboTax Online is a tax preparation software that allows users to file their taxes online. The software is designed to be user-friendly, and it provides step-by-step instructions to help users complete their tax returns. TurboTax online is a popular choice for taxpayers who want to file their taxes from the comfort of their own homes.

Here’s a quick overview of how it works:

First, you’ll need to create an account and provide some basic information about yourself. Then, you’ll answer questions about your income, deductions, and credits.

TurboTax will use this information to fill out your tax return forms for you. Once your return is complete, you can review it and make any changes or corrections before you file.

When you’re ready to file, you can do so electronically through TurboTax, or you can print and mail your return. Either way, you’ll need to pay any taxes that are due.

If you’re expecting a refund, TurboTax will help you choose the best way to receive it – either by direct deposit into your bank account, or by check.

And that’s it! Using TurboTax online is a quick and easy way to file your taxes.

TurboTax Online Deluxe is tax preparation software that helps users file their taxes online. The software is designed to be user-friendly and includes step-by-step instructions to help users complete their tax returns. TurboTax online deluxe also offers a variety of features to help users maximize their tax deductions and minimize their tax liability.

[…] TurboTax is one of the most popular tax software options on the market. They offer a variety of different products, including a cryptocurrency tax software option. The software is designed to be user-friendly and is a good choice for those who are not familiar with cryptocurrency taxes. […]

[…] Take Away: Also, be sure to check out the blog post about Turbo Tax Online Filling […]